You can keep it there or transfer it to a linked bank account. Transfer MoneyĪny money you receive via Cash App is added to your Cash App balance by default.

You can also search for individuals by name, phone number or email address, and you can choose to send funds from your Cash App balance or your linked funding source. You can find individuals and businesses by searching for their $Cashtag in Cash App, then you can request or transfer funds. Users can enter a dollar amount from the green payment tab and tap “Request” or “Pay” to create a payment.Įach Cash App user creates a unique username, called a $Cashtag.

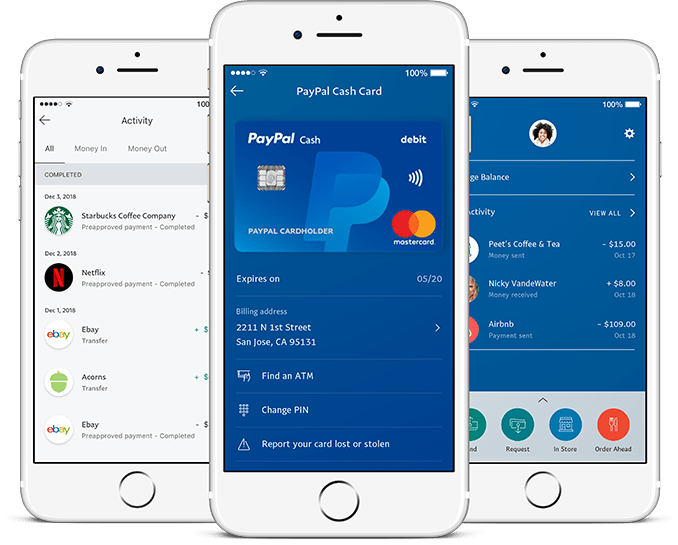

Once a payment source is connected, you can send or receive money through the mobile app. Send and Receive MoneyĪfter setting up a Cash App account, you’ll need to link it to an existing bank account. The app features several tabs for its various services, including banking, debit card, payments, investing and bitcoin. You can also sign up for an account online.

#Cash app to paypal download

To use Cash App, you must first download the mobile app, available for iOS and Android. With this feature, Cash App is quickly becoming a one-stop shop for financial services. With Cash App Taxes (formerly Credit Karma Tax), users can file their taxes for free. Consumers can also buy, sell or transfer bitcoin through the app. This is done by buying a portion of a stock, called a fractional share. The investing feature lets users invest in stocks for as little as $1.

Through Cash App, users can send and receive money, get a debit card and receive direct deposits. Cash App provides investing services through Cash App Investing LLC, registered with the Securities and Exchange Commission as a broker-dealer and a member of the Financial Industry Regulation Authority. The balance in your account is insured by the Federal Deposit Insurance Corporation through partner banks. It provides banking services and debit cards through its bank partners. Block, Inc., formerly Square, Inc., launched the app, initially named Square Cash, in 2013 to compete with mobile payment apps like Venmo and PayPal.Ĭash App is a financial platform, not a bank. Hopefully, this article helped you and you’re able to find what you’re looking for.Via CurrencyFair's Website What Is Cash App?Ĭash App is a P2P payment app that lets individuals quickly send, receive and invest money. As for PayPal, requesting a withdrawal will cost the user a fee of 30 cents which also includes 2.9% of the total amount. When doing instant withdrawal, the fees will be 1.5% of your total withdrawal. Is Cash App cheaper than PayPal?Ĭash App only charges users a fee when the owner of the account requests for an instant withdrawal to their bank account. If you’re constantly shopping online, then you’re likely to use PayPal more than Cash App. You can request a debit card from both companies. Cash App is more user friendly with benefits like investing in stocks and cryptocurrencies. With PayPal, you can shop online through many e-commerce stores. Is PayPal and Cash App the same?Ĭash App and PayPal work in similar ways except both have their pros and cons. This might help benefit future readers! Don’t hesitate to comment and ask questions if you don’t find what you’re looking for here.

Here are the commonly asked questions when it comes to Cash App and PayPal. After connecting PayPal and adding your funds, you’re all set! Near the PayPal balance, you will see where it says ‘Add Cash.’ Click on that. Now that the money is in your bank, connect your bank to your PayPal account. You can wait a few days or pay extra to transfer instantly. Make sure that your bank account is connected, not PayPal. Tap on ‘Cash Out’ to cash out your funds. Tap on the house on the bottom left of your screen. In this method, you will be transferring your Cash App money straight to your bank account.

0 kommentar(er)

0 kommentar(er)